Electronic Production in India

operate in this sector

and abundant talent pool

Industry outlook, Opportunity in Telangana

India

USD 70 Billion | Values of Electronics produced in India | ||

25% | CAGR of Electronics Industry in

India

From 2015-20

| ||

2nd | India’s rank in mobile

manufacturing in the world in

2018 in volume | ||

USD 5 Trillion | India’s GDP target by 2025

| ||

India’s share in global

electronics manufacturing | 3% | ||

Export of electronic goods

in 2018-19 | USD 8.8 Billion | ||

India’s budgetary outlay for

Electronics Industry Schemes | USD 6.5 Billion

| ||

Employment generated by India’s electronics manufacturing

industry | 20 Lakhs

| ||

Telangana

Telangana State’s Electronics Manufacturing contributed INR 76,410 Crores in 2019-20, accounting for ~ 13% of the State’s Industrial GVA.

- ESDM Policy launched in State to facilitate Electronics Investments.

- 2 ESDM clusters at e-City, Raviryala (602 Acres) & Maheshwaram Park (310 Acres).

- Key global players such as Nvidia, Motorola, Qualcomm, AMD, CDAC, Cypress, etc.,

- Home grown companies such as BHEL, BEL, HBL, ECIL, etc.

- Recently attracted investments from majors such as Apple, Micromax, HFCL, Resolute, etc.

- OPPO and OnePlus establishing design & development centres creating 1000+ technical jobs.

ELECTRONIC SECTOR PERFORMANCE - TELANGANA

- ESDM Policy is launched in state to facilitate Electronic Investments.

- 2 ESDM Clusters at e-city, Raviryala(602 Acres) & Maheshwaram Park(310 Acres).

- Currently accounts for 6% of the electronics production in the country.

- Over 250 companies employing more than 50,000 employees across different sub-segments.

- Key Global players such as NVidia, Motorola, Qualcomm, AMD, CDAC, Cypress. etc.

- Home grown companies such as BHEL, BEL, HBL, ECIL, etc.

- Recently attracted investments from majors such as Apple, Micromax, HFCL, Resolute, etc.

- OPPO and OnePlus establishing design & development centres creating 1000+ technical jobs.

Segment-wise contribution of Industries in Telangana to the state's electronics GVA

Telangana State’s Electronics Manufacturing contributed INR 76,410 Crores in 2019-20, accounting for ~ 13% of the State’s Industrial GVA

FOCUS Sectors

Mega Projects

- Handsets, OEMs, consumer electronics

- Semiconductor facilities Independent Foundrie

- Display Fabrication & Photonics LED Chip Fabrication Units.

Electronics Components Manufacturing System

- Core components like PCBs, switches, etc.

- Lithium-ion cells

- Fuel cells

- Preform of Silica

Electronics Manufacturing Services Industry

- Design and assembly of PCBs

- Functional testing and maintenance services.

Assembly, Testing, Marking and Packaging Industry

- Providing AMTP lines for

- Semiconductor ICs,

ELECTRONICS POLICY-INCENTIVES CHART

Electonics Wing, ITE&C Dept, Govt. of Telangana

Electronic Policy-Incentive Chart-Core, Mobile & Consumer Electronics

Parameters | TS Electronics policy-Core | TS Electronics Policy-Mobile | TS Electronics Policy-Con.Elec. | |||

|---|---|---|---|---|---|---|

Values | Caps | Values | Caps | Values | Caps | |

Capital Cost Reimbursements | 20% | INR 2 Cr. | 20% | INR 10 Cr. | 20% | INr 15 Cr. |

Land Rebate(Discount % of Market Price) | 60% | 60% | 60% | |||

Lease Rentals Assistance | 25% | 10 Years | 25% | 10 Years | 25% | 10 Years |

Interest Subsidy | 5.25% | 5 Years (INR 5Cr.0)

| 5.25% | 5 Years (INR 5Cr.0) | 5.25% | 5 Years (INR 5Cr.0) |

Power Subsidy | 25% | 3 Years (INR 30L) | 25% | 3 Years (INR 30L) | 25% | 3 Years (INR 30L) |

SGST Reimbursements | 100% | 7 Years | 100% | 7 Years | 100% | 7 Years |

Skill Development Assistance | TASK | TASK | TASK | |||

Electricity Duty Exemption | 100% | 5 Years (INR 50L) | 100% | 5 Years (INR 50L) | 100% | 5 Years (INR 50L) |

Transport Subsidy | 60% with 10% redcution yoy | 5 Years (INR 5 Cr.) | 60% with 10% redcution yoy | 5 Years (INR 5 Cr.) | 60% with 10% redcution yoy | 5 Years (INR 5 Cr.)

|

Stamp Duty/ Transfer Duty/ Registration Fees Reimbursements | 100% on first/ 50% on second transaction | 100% on first/ 50% on second transaction | 100% on first/ 50% on second transaction

| |||

Quality Certification Reimbursements | 50% | INR 2L | 50% | INR 2L | 50% | INR 2L

|

Patent Registration Reimbursements | 50% | INR 2L

| 100% | INR 5L

| 50% | INR 2L |

Cleaner Production Practices

| 25% | INR 5L

| 25% | INR 5L

| 25% | INR 5L |

Exhibition Reimbursements | 50% | INR 5L | 50% | INR 5L | 50% | INR 5L |

ELECTRONICS POLICY-INCENTIVES CHART

Electonics Wing, ITE&C Dept, Govt. of Telangana

Electronic Policy-Incentive Chart-LED, PCB Assembly & Mega Projects (Customized)

Parameters | TS Electronics policy-LED | TS Electronics Policy-PCBA | TS Electronics Policy-Mega (Customized) | |||

|---|---|---|---|---|---|---|

Values | Caps | Values | Caps | Values | Caps | |

Capital Cost Reimbursements | 20% | INR 2 Cr. | 25% | 5 Cr. | 20% | 30 Cr. |

Land Rebate(Discount % of Market Price) | 60% | 60% | 60% | |||

Lease Rentals Assistance | 25% | 10 Years | 25% | 10 Years | 25% | 10 Years |

Interest Subsidy | 5.25% | 5 Years (INR 2.50 Cr.)

| 5.25% | 5 Years (INR 5Cr.) | 5.25% | 5 Years (INR 5Cr.) |

Power Subsidy | INR 1.5 per unit | 5 Years (INR 50L) | 25% | 3 Years (INR 30L) | INR 1.5 per unit | 5 Years (INR 5 cr.) |

SGST Reimbursements | 100% | 7 Years | 100% | 7 Years | 100% | 7 Years |

Skill Development Assistance | TASK | TASK | TASK | |||

Electricity Duty Exemption | 100% | 5 Years (INR 50L) | 100% | 5 Years (INR 50L) | 100% | 5 Years (INR 50L) |

Transport Subsidy | 60% with 10% redcution yoy | 5 Years (INR 5 Cr.) | 60% with 10% redcution yoy | 5 Years (INR 5 Cr.) | 60% with 10% redcution yoy | 5 Years (INR 5 Cr.)

|

Stamp Duty/ Transfer Duty/ Registration Fees Reimbursements | 100% on first/ 50% on second transaction | 100% on first/ 50% on second transaction | 100% on first/ 50% on second transaction

| |||

Quality Certification Reimbursements | 50% | INR 2L | 50% | INR 2L | 50% | INR 2L

|

Patent Registration Reimbursements | 50% | INR 2L

| 100% | INR 5L

| 50% | INR 5L |

Cleaner Production Practices

| 25% | INR 5L

| 25% | INR 5L

| 25% | INR 5L |

Exhibition Reimbursements | 50% | INR 50k | 50% | INR 5L | 50% | INR 5L |

SUB-Sectors

Electronics design automation, protyping

- Sourcing for Defence / Space

- Avionics Manufacturing

The state of Telangana one of the major Aerospace and Defence hubs in the country and has a huge scope in the sub sectors –Avionics & Defence Electronics.

4 Aerospace Parks and 2 upcoming Parks (10 mins from Airport)

- Adibatla SEZ, Nadergul DTA, Hardware Park 1, Hardware Park 2, GMR SEZ, Adani Park, E- City AND Eliminedu

- Key Players: Presence of Key players like Safran, CFM, Honeywell Aerospace, GE, Elbit Systems, etc.

- Hyderabad has a strong presence of Defence PSUs, scientific & technological institutes along with R&D agencies – ARCI, DRDO, etc.

- Relatively low cost aerospace manufacturing & MRO hub for Asia-Pacific and Middle East provides a competitive edge. Hyderabad is a seismically safe city as it falls under seismic zone.

The state of Telangana is also the Pharma Capital of India – Medical Electronics

Medical Devices Park (50 minutes from Airport)

- India’s largest medical devices park

- Houses Asia’s largest coronary stent manufacturing facility

Telangana has over 800+ Pharma & Biotech firms valued at USD 50 Bn, it is the Vaccine capital of the world and accounts for 40% of India’s Bulk drug production. With a growth of 2.4x in Pharma exports and the presence of large multi-nationals like Dr. Reddy’s, Novartis, Biological E and Medtronic and the supply chain, Telangana presents a huge potential for Medical Electronics.

- Components for EVs, drones, intelligent transport systems and automations.

- Electric Vehicles and Energy Storage Systems

- Telangana state aims to target 50GWH of storage demand by 2025.

- The state has emerged as a pioneer for creating a conducive policy environment for all the ecosystem of EV’s.

- Telangana is a key player in the national EV ecosystem with existing players like BYD-Olectra, Pure EV and Mahindra Electric, Fortum etc.

- Out of a total of 150+ charging stations and more than 40 are located in Hyderabad, among the highest for any city in India.

- The Government of Telangana is poised to apply for the Govt of India GiGa Factory Scheme by NITI Aayog for 10GWh lithium cell manufacturing facility.

- Major markets for battery cells in India include Electric vehicles, Station Energy Storage Solutions and Consumer Electronics.

Vehicle Category | Base Case Demand | Best Case Demand |

|---|---|---|

2 wheelers (Private) | 2,240,624 | 4,883,958 |

3 wheelers | 96,588 | 174,138 |

4 wheeler (Pvt Car) | 290,578 | 370,360 |

Commercial Cars/Taxis/LCV Passenger | 36,798 | 86,065 |

Buses | 7,968 | 11,570 |

LCV Goods Carrier | 133,405 | 266,728 |

Major Investments

Government Support

Incentive Type | Amount/Capital |

|---|---|

Capital Investment Subsidy | 20% Capped at INR 30 Cr. (USD 4,285,000) for Mega Enterprises; INR 2 Cr. (USD 285,000) for Others |

SGST Reimbursement | 100 % net SGST for 7 years; Capped to investments made in plant and machinery.;

Capped at INR 2 Cr. (USD 285,000) for 5 years for Micro & Small Enterprises

|

Power Tariff Discount | 25% for 5 years Capped at INR 5 Cr. (USD 710,000) for Mega Enterprises; Capped at INR 30 Lakh (USD 42000) for 3 years for Others |

Electricity Duty Exemption | 100% for 5 years; Capped at INR 5 Cr. (USD 710,000) |

Interest Subvention | 5.25% for 5 years; Capped at INR 5 Cr. (USD 710,000) |

Transportation Subsidy | 60% with 10% reduction YoY – for 5 years; Capped at INR 5 Cr. (USD 710,000) |

Stamp Duty/ Transfer Duty/ Registration Fees Reimbursements | 100% on first, 50% on second transaction |

Lease Rental Assistance | 25% subsidy on lease rentals for a period of 10 years |

Assistance in Patent Filing | 50% of the cost of filing patents; Capped at INR 5 Lakh (USD 7,100) for Mega Enterprises and INR 2 Lakh (USD 2,800) for others |

Reimbursement Quality Certification costs | 50% of the cost uncured for certification; Capped at INR 2 Lakh (USD 2,800)

(Conformity European (CE), China Compulsory Certificate (CCC), UL Certification, ISO, CMM Certification, SA, RU etc.)

|

Cleaner Production Practices | 25% of the cost incurred; Capped at INR 5 Lakh (USD 7,100) |

Exhibition Cost Reimbursements | 50% of the cost of filing patents; Capped at INR 5 Lakh (USD 7,100) |

Skill Development Assistance | Skill Development Assistance will by provided by Telangana Academy for Skills & Knowledge |

Government Support - Infrastructure

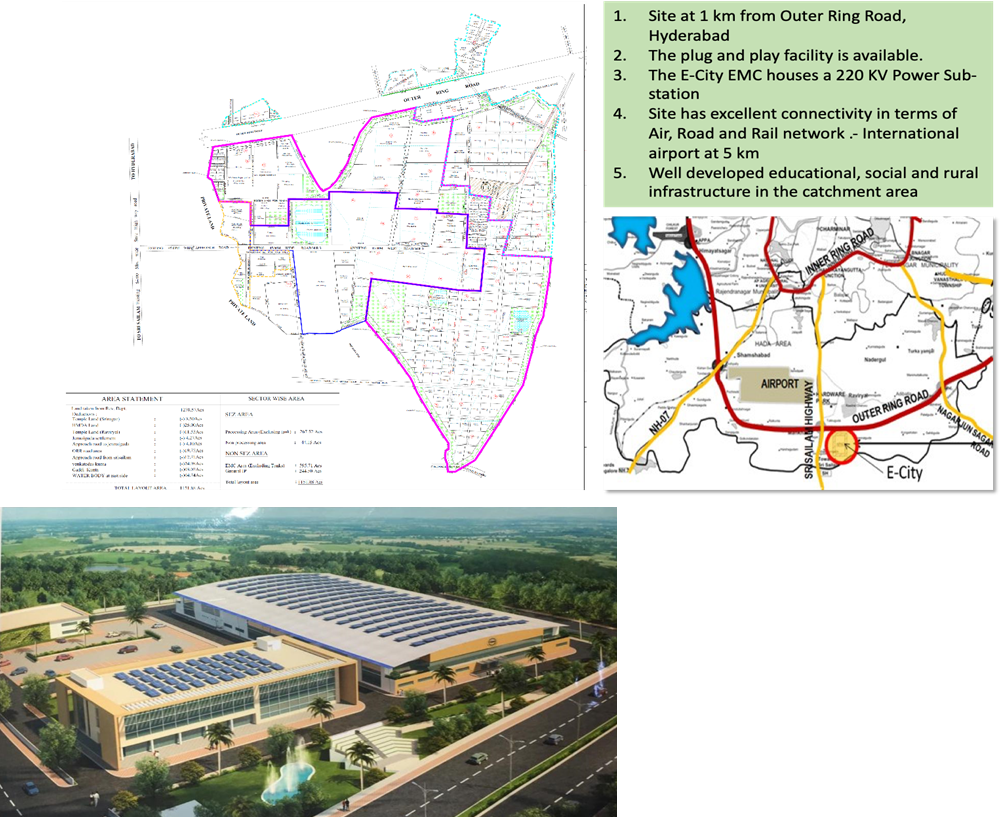

E-City Hardware Park EMC (EMC1):

- LAND: 602 acres of EMC land (SEZ land of 263 acres) with plug and play facility. 2,00,000 sq. ft. BUA of ready to move-in plug-and-play factory space.

- Road and Rail Connectivity: 1 km from Outer Ring Road, Hyderabad.

- 158 Km freeway (ORR) around Hyderabad.

- 72 km stretch PPP metro rail by L&T.

- Inland freight cost per tonne from Chennai Port at 38 USD.

- AIRPORT CONNECTIVITY: 5 Kms from Hyderabad International Airport.

- POWER: 220 kV power sub-station

- 300 MLD Surplus Water Supply for Industries

- Cost of water is 0.40 USD per 10 KLD.

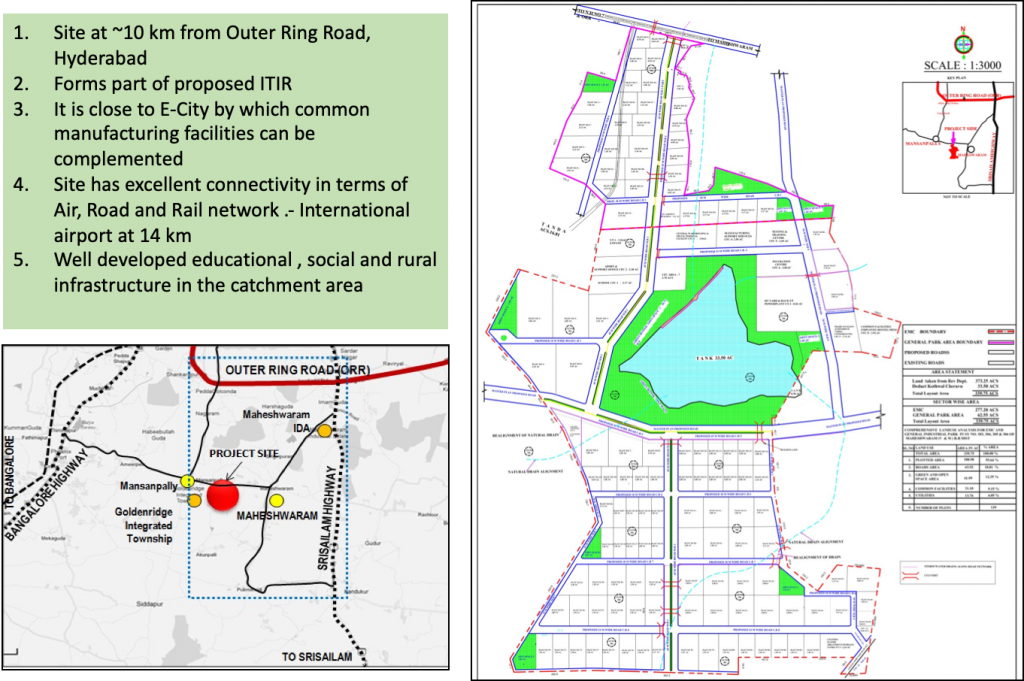

Maheshwaram Science Park (EMC2):

- LAND: 310 acres of EMC land with plug and play facility.

- Road and Rail Connectivity: 10 km from Outer Ring Road, Hyderabad.

- 158 Km freeway (ORR) around Hyderabad.p

- AIRPORT CONNECTIVITY:

- 14 Kms from Hyderabad International Airport.

- 60% discount on Land Price

- 20% of Land Reserved for Dormitories.

- It is close to E-City by which common manufacturing facilities can be complemented

- Well developed social, educational and rural infrastructure in the catchment area.

GOVERNMENT OF INDIA SUPPORT(GOI Electronics Schemes)

Production Linked Incentives | -To attract large scale investments in mobile phone manufacturing and specified electronic components, including Assembly, Testing, Marking and Packaging (ATMP) units. -Incentive of 4% to 6% on incremental sales for 5 years. -Budgetary outlay of INR 40,995 crore for 5 years. |

Specs | -Financial incentive of 25% on capital expenditure for electronic components, semiconductor/ display fabrication units, ATMP units, specialized sub-assemblies and capital goods, etc. -Applicable to investments in new units and expansion of capacity/ modernization and diversification of existing units. -Applicable to investments in new units and expansion of capacity/ modernization and diversification of existing units |

EMC 2.0 | -Financial assistance up to 50% of the project cost subject to ceiling of Rs.70 crore per 100 acres of land for setting up of Electronics Manufacturing Cluster projects. -Financial assistance of 75% of the project cost subject to a ceiling of Rs.75 crore for Common Facility Centre (CFC) -Budgetary outlay of Rs. 3,762.25 crore for this scheme over a period of 8 years |

Eligibility & Timelines – Industrial Parks/ Units – GOVERNMENT O INDIA POLICIES MENTIONEDE ABOVE

Production Linked Incentive Scheme | Specs | EMC 2.0 | |

|---|---|---|---|

Target Segments

| -To promote large scale manufacturing which includes mobile phones and electronics

components

| -To promote domestic manufacturing of components and semiconductors to strengthen supply chain. -Investment threshold from INR 5 crore to INR 1000 Cr. | -Incentives for Electronics Manufacturing Clusters (200 acres for new EMC or 100 acres for expansion of EMCs). -Anchor unit min Inv of 300 Cr and atleast 20% land. |

Tenure | -Support shall be provided for 5 years starting from FY 2019-20. -Applications period of 4 months. | -Incentives for investments made in 5 years from date of application. -Applications period of 3 years. | -Applications period of 3 years. -Disbursement of incentives for a further period of 5 years. |

Eligibility | Based on Incremental investment and Incremental sales of manufactured goods. | -Investments that have already claimed M-SIPS are not eligible. -Applicants can claim other incentives from other schemes as well (except M-SIPS). | State Government or State Implementing Agency (SIA) or Central Public Sector Unit (CPSU) or State Public Sector Unit (SPSU) or Industrial Corridor Development Corporation (ICDC) to submit the application.

|

Government of India – Key Initiatives impacting Electronics Industry

Electronics products | Tariff changes (Basic Customs Duty) |

|---|---|

Printed Circuit Board Assembly (PCBA) of cellular mobile phones | Increased from 10% to 20% |

Vibrator Motor/ Ringer for use in the manufacture of cellular mobile phones | 10% |

Display Assembly for use in the manufacture of cellular mobile phones | 10% |

Touch Panel/ Cover Glass Assembly for use in the manufacture of cellular mobile phones | 10% |

Microphone Cartridge, Holder, Grill, Body | Exempt from BCD |

Micro Fuse Base, Sub-Miniature Fuse Base, Micro Fuse Cover and Sub-Miniature Fuse Cover | Exempt from BCD |

Liquid Crystal Polymer | Exempt from BCD |

Charger or power adapter (except those in ITA1) | Increased to 20% |

Fingerprint readers/scanners | 15% |

Health Cess on medical devices | 5% |

- Some of the key initiatives on BCD based on their usage and certain.

- GOI has also reviewed the extant FDI policy amidst Covid 19 Pandemic.

Further details can be accessed from Link.

Industry Speaks

Government of Telangana || Electronic Policy

Partner Organizations

Premier Technical Institutes for Skilling include:

- Electronics Test and Development center (ETDC)

- Central institute of Plastics Engineering and Technology. (CIPET)

- Central Institute of Tool Design.

- ECIL

- BHEL

Research (Access to IP & Protection)

- Telangana Technology Research Institute (TTRI)

- Research & Innovation Circle, Hyderabad (RICH)

- Tech Universities & Central Institutes

Queries

Got questions on Policy Suggestions & Clarifications, Unsolicited Proposal Submissions, Grievance Collections

Click on the button below and share your queries with us!

Investing in us?

Please get in touch with us by sharing your details and our team will reach out to assist you with the same.

Click on the button below!

Downloads

Address:

INVEST TELANGANA CELL,

Industries and Commerce Department,

3rd Floor, Dr. B.R. Ambedkar Telangana Secretariat Rd, Central Secretariat, Khairtabad, Hyderabad, Telangana 500022

Should you have any questions, or wish to speak to our Qualified Financial Advisors at Telangana, Please Contact Us.

Developed by Outshade Digital Media